Employee Benefit Plans

Benefit Plans and Eligibility

How do you know when your employees are eligible for benefits and in which plans? We have answers to all your questions around benefits and eligibility.

Eligibility for the benefit plans depends on employee job status and other factors.

3sHealth administers group life, extended health care, dental, and disability income plans for health-care system employees.

We are your contact point for everything related to these benefits and disability plans.

Do you have questions about benefit plans and eligibility? This section provides information on everything you need to know.

Group Life Insurance Plan

Permanent positions

In a permanent full-time or part-time position, employees are eligible for the Group Life Insurance Plan on their first day of work. 3sHealth Employee Benefits will send them a “welcome package” within a few weeks. The package includes:

- A letter confirming which benefit plans they are enrolled in and their Benefit ID (BID) number;

- Information about their benefit plans; and

- An Enrolment Information Form.

Casual or temporary positions

After working for 26 weeks, 3sHealth Employee Benefits will measure the employee for eligibility in the Group Life Insurance Plan. To qualify, they must work a minimum of 390 hours in their first 26 weeks of work.

Eligible plan members have Basic Life and Basic Accidental Death & Dismemberment (AD&D) insurance coverage for themselves, as well as Dependent Life insurance for their eligible dependents.

Basic Life insurance: If your employee is under the age of 65, the plan calculates their Basic Life insurance amount based on two times their annual salary, rounded up to the nearest $1,000, to a maximum of $1,000,000. This amount is the life insurance proceeds your employee’s named beneficiaries will receive if they pass away.

If your employee is 65 or older and working, the plan calculates their Basic Life insurance amount based on their annual salary, rounded up to the nearest $1,000, to a maximum of $250,000. This amount will be the life insurance proceeds your employee’s named beneficiaries will receive if they pass away.

Dependent Life insurance: The plans cover your employee’s spouse’s life at $20,000 and their eligible children’s lives at $10,000 per child. This benefit is payable to the plan member.

Basic Accidental Death & Dismemberment (AD&D) insurance: Regardless of age, your employee has AD&D insurance. The amount of their AD&D insurance is equal to the amount of their Basic Life insurance, and is paid out if they pass away due to an accident.

For injuries sustained by an accident, your employee’s Basic AD&D insurance is equal to a percentage of their Basic Life insurance. Coverage is based on the current “table of losses.” The table of losses details how much coverage your employee will have in the event of a loss of life, limb, sight, hearing, or speech. See the Group Life Insurance Plan booklet for the table, which is on page 10.

| Example |

|---|

| Example: Manpreet makes $50,000 a year. Her Basic Life insurance is $100,000. Basic AD&D is equal to a percentage of this Basic Life insurance depending on the type of loss. Manpreet is in a car accident. If she suffers hearing loss in both ears, she will receive $50,000 because the plan covers hearing loss in both ears at 50 per cent. If Manpreet died as a result of the car accident, then the death benefit payable to her beneficiaries would be $200,000 ($100,000 basic life and $100,000 AD&D). |

The monthly premium rate for each employee’s Group Life insurance is $0.15 per $1,000 of coverage. This premium covers Basic Life insurance, Basic Accidental Death & Dismemberment (AD&D) insurance, and Dependent Life insurance coverage.

To calculate an employee’s monthly premium amount, multiply the amount of their insurance by $0.15 and divide by $1,000.

| Examples |

|---|

Example – for someone making $66,000 a year who is under the age of 65: $66,000 x 2 = $122,000 (amount of coverage). ($122,000 x $0.15) / $1,000 = $18.30 monthly premium amount. |

Example – for someone making $66,000 a year who is over the age of 65: $66,000 x 1 = $66,000 (amount of coverage). ($66,000 x $0.15) / $1,000 = $9.90 monthly premium amount. Collective Bargaining Agreements outline what portion of the premiums are employer paid versus employee paid. For organizations with out-of-scope employees, each organization can determine if there is an employee pay portion. 3sHealth requires that premiums be paid by the employer on the 10th of each month. |

Yes. If your employee is under 65, and is enrolled in the Group Life Insurance Plan, they can purchase additional life insurance coverage called, “Employee Optional Life insurance.”

Eligible employees can purchase up to a maximum of $500,000 of additional Employee Optional Life insurance coverage. If they apply in the first 90 days of enrolment in the plan, they can purchase up to $150,000 of this coverage without providing any additional medical information.

If they purchase coverage after 90 days of enrolment in the plan or more than $150,000 of coverage, Canada Life requires them to complete a Medical Evidence of Insurability form. They may contact our office for the form. Canada Life is 3sHealth’s insuring partner for Optional Life insurance.

The plan provides Employee Optional Life insurance in units of $10,000 to a maximum of $500,000. The rates are based on the employee’s age and whether they are a smoker or non-smoker.

| Non-smoker | Age | Smoker |

| 0.044 | Under 39 | 0.088 |

| 0.075 | 40-44 | 0.150 |

| 0.106 | 45-49 | 0.213 |

| 0.250 | 50-54 | 0.450 |

| 0.425 | 55-59 | 0.750 |

| 0.594 | 60-64 | 1.050 |

The monthly premium calculation is: multiply the amount of insurance by the rate and divide by $1,000.

| Example |

|---|

| Example – for a 42-year-old non-smoker: ($100,000 x $0.075) / $1,000 = $7.50 monthly premium. |

Yes. Your employee can purchase additional “Voluntary” AD&D insurance under the Group Life Insurance Plan.

This purchase can be made at any time if they are eligible for the Group Life Insurance Plan. The plan has single and family coverage available. They can buy up to $250,000 in Voluntary AD&D coverage in $10,000 units. The plan does not require a medical review for this coverage.

The plan provides Voluntary AD&D insurance in units of $10,000 to a maximum of $250,000. The rates per $10,000 of coverage are $0.02 for single plan member coverage and $0.04 for family coverage.

The monthly premium calculation is: multiply the amount of insurance by the rate and divide by $1,000.

| Examples |

|---|

| Example – single coverage: ($50,000 x $0.02) / $1,000 = $1.00 monthly premium. |

| Example – family coverage: ($50,000 x $0.04) / $1,000 = $2.00 monthly premium. |

Yes, there is an option to purchase additional coverage for your spouse. There is, however, no option to purchase additional Dependent Life insurance beyond the coverage the plans already provide for your children. The plan covers your spouse’s life at $20,000 and your eligible children’s lives at $10,000 per child (both rates were doubled as of January 1, 2026).

You can purchase Spousal Optional insurance on your spouse to a maximum of $150,000 in units of $10,000. If you are purchasing more than $50,000 or you have chosen to purchase past the 90-day window, your spouse must complete a Medical Evidence of Insurability form.

Yes. If your employee is enrolled in the Group Life Insurance Plan and their spouse in under age 65, they can purchase “Spousal Optional Life insurance.”

Eligible employees can purchase up to a maximum of $150,000 of Spousal Optional Life insurance coverage. If they apply in the first 90 days of enrolment in the plan, they can purchase up to $50,000 of this coverage without providing any additional medical information.

If they purchase coverage after 90 days of enrolment in the plan or more than $50,000 of coverage, Canada Life requires them to complete a Medical Evidence of Insurability form. They may contact our office for the form. Canada Life is 3sHealth’s insuring partner for Spousal Optional Life insurance.

The plan provides Spousal Optional Life insurance in units of $10,000 to a maximum of $150,000. The rates are based on the spouse’s age and whether they are a smoker or non-smoker.

| Non-smoker | Age | Smoker |

| 0.044 | Under 39 | 0.088 |

| 0.075 | 40-44 | 0.150 |

| 0.106 | 45-49 | 0.213 |

| 0.250 | 50-54 | 0.450 |

| 0.425 | 55-59 | 0.750 |

| 0.594 | 60-64 | 1.050 |

The monthly premium calculation is: multiply the amount of insurance by the rate and divide by $1,000.

Example| Example – for a 42-year-old non-smoker: ($100,000 x $0.075) / $1,000 = $7.50 monthly premium. |

Employees can complete the Group Life Beneficiary Designation Form and send a signed copy of the completed form to ebp@3sHealth.ca.

3sHealth also includes a form in the employees’ welcome packages.

Employees can name beneficiaries to two types of groups:

- Primary beneficiary(ies) - the person(s) who will receive the policy proceeds if you die.

- Contingent beneficiary(ies) - the person(s) who will receive the proceeds if your primary beneficiary(ies) die before you.

Employees may name any person as their beneficiary, such as their spouse, parent, child, or anyone else in their life. They may designate more than one beneficiary. Employees may also name a legal entity as their beneficiary, such as a charitable organization. If they choose to name a charitable organization as a beneficiary, 3sHealth requires the full legal name and address of the charitable organization. The charity must be a registered charity.

Important note: Many employees ask if they should let their Group Life insurance proceeds simply go to their estate rather than having to choose and update beneficiaries. Sending their insurance proceeds to their estate is possible, but we advise that they pick and name their beneficiaries. The reason is simple: picking beneficiaries now is easier on their loved ones and ensures that every dollar ends up in their hands. Life insurance proceeds to an estate are subject to estate taxes and fees, and executors may need to use life insurance proceeds to pay off debts before settling the estate.

If your employee names a minor child under the age of 18 as a beneficiary, they must also appoint a trustee. Upon their death, we send the trustee the policy proceeds. The trustee has a legal duty to use those proceeds for the benefit of the beneficiary. Employees will want to appoint someone capable of managing the policy proceeds wisely.

If they do not appoint a trustee, the law requires that we send the payment to the public trustee in the child’s province of residence or to the court-appointed property guardian.

Employees cannot name a beneficiary for their Spousal Optional Life as the proceeds automatically go to the plan member (employee) in the event of their spouse passing.

A beneficiary cannot be named for Spousal Optional Life insurance as the proceeds would automatically be paid to the plan member.

If your employee does not name a beneficiary or their beneficiary dies before them, 3sHealth will pay their Group Life insurance proceeds to their estate.

Important note: Many employees ask if they should let their Group Life insurance proceeds simply go to their estate rather than having to choose and update beneficiaries. Sending their insurance proceeds to their estate is possible but we advise that they pick and name their beneficiaries now. The reason is simple: picking beneficiaries now is easier on their loved ones and ensures that every dollar ends up in their hands. Life insurance proceeds to an estate are subject to estate taxes and fees, and executors may need to use life insurance proceeds to pay off debts before settling the estate.

When your employee designates their beneficiaries, they may indicate the percentage of the policy proceeds they would like to give to each of the named parties. Their designations for all named primary beneficiaries must total 100 per cent. If they name contingent beneficiaries, their total must also equal 100 per cent. If they do not detail a percentage of the benefit for each beneficiary, the plan divides the policy proceeds equally among their named beneficiaries.

Employee Benefits Dependent Change Form

Employees may use the Employee Benefits Dependent Change Form to:

- Add or change information about their spouse;

- Remove a spouse; and

- Add, change, or remove information about their dependent children.

Completed forms can be submitted to 3sHealth ebp@3sHealth.ca.

If your employee works at multiple different employers that participate in the Group Life Insurance Plan that 3sHealth administers, it is important to note that they are only in the Group Life Insurance Plan once. The plan calculates their Group Life insurance coverage based on their salary at all their positions where employers participate in the plan.

Only one beneficiary designation can be in place at a time, even if your employee works at multiple health-care organizations. When they make a new beneficiary designation, that new designation replaces all other previous designations. This replacement happens even if they made the previous designation at a former employer.

Your employee’s new beneficiary designation must be a full and complete designation that clearly states how they wish the policy proceeds to be disbursed in the event of their death.

For complete details on the plan, please review the Group Life Insurance Plan booklet.

Disability Income Plans

Permanent full-time and part-time positions

In a permanent full-time or part-time position, employees are eligible for the Disability Income Plans on their first day of work. 3sHealth Employee Benefits will send them a “welcome package” within a few weeks. The package includes:

- A letter confirming which benefit plans they are enrolled in and their Benefit ID (BID) number;

- Information about their benefit plans; and

- An Enrolment Information Form.

Casual positions

After working for 26 weeks, 3sHealth Employee Benefits will measure casual employees for eligibility in the Disability Income Plans. To qualify, they must work a minimum of 390 hours in their first 26 weeks of work.

Temporary positions

If they are a member of the Saskatchewan Union of Nurses (SUN) and are a temporary employee, they are eligible for membership in the SUN Disability Income Plan on their date of hire, providing that they are under the age of 65. All other temporary employees not in SUN are not eligible to join the Disability Income Plan.

There are four different Disability Income Plans: CUPE, General, SEIU-West, and SUN. Your employee’s disability coverage level depends on which plan they belong to.

- CUPE:

- During the initial 119-day long-term disability qualifying period, bridge benefits equal to 66 and 2/3 per cent of your employee’s pre-disability regular gross weekly earnings.

- After the initial 119-day qualifying period, long-term disability benefits equal to 60 per cent of your employee’s pre-disability regular gross monthly earnings.

- General:

- After the initial 119-day qualifying period, long-term disability benefits equal to 75 per cent of your employee’s pre-disability regular gross monthly earnings.

- After the initial 119-day qualifying period, long-term disability benefits equal to 75 per cent of your employee’s pre-disability regular gross monthly earnings.

- SEIU-West:

- During the initial 119-day long-term disability qualifying period, bridge benefits equal to 66 and 2/3 per cent of your employee’s pre-disability regular gross weekly earnings.

- After the initial 119-day qualifying period, long-term disability benefits equal to 60 per cent of your employee’s pre-disability regular gross monthly earnings.

- SUN:

- After the initial 119-day qualifying period, long-term disability benefits equal to 75 per cent of your employee’s pre-disability regular gross monthly earnings.

Bridge benefits are an income replacement benefit that bridges the gap in time between the end of your employee’s employer-paid sick leave and the 119-day qualifying period for long-term disability benefits.

Bridge benefits are only available to CUPE and SEIU-West plan members.

If your employee needs to apply for disability benefits, please refer them to the Applying for Disability Benefits link https://www.3shealth.ca/applying-for-disability-benefits page on our website. This page provides all the necessary forms and information they will need when applying for disability benefits, including the Employer’s Initial Application Form that they will need to complete and submit.

Employers must complete the Employer’s Initial Application Form and submit it to ebp@3sHealth. We ask that you submit this form on the 89th day of the employee’s absence so we can start the process.

This form must contain accurate information to ensure there are no overpayments or underpayments on an approved disability claim. Contact 3sHealth if you have questions when completing the form.

For full details, please review the booklet for your employee’s plan by clicking the appropriate link in the list below.

- CUPE - Long-term Disability Plan

- GENERAL - Long-term Disability Plan

- SEIU-West - Long-term Disability Plan

- SUN - Long-term Disability Plan

Core Dental

Permanent full-time positions

Employees will be eligible for dental benefits after working for 26 weeks. When they first gain coverage under the Core Dental Plan, Canada Life will send them their pay direct drug card in the mail within three to four weeks. If they have a spouse, Canada Life will also send them a card.

Permanent part-time, casual, or temporary positions

After working for 26 weeks, we will measure your employee for eligibility in the Core Dental Plan. To qualify, they must work a minimum of 390 hours in their first 26 weeks of work. The number of hours they work compared to your organization’s full-time hours will determine the percentage of dental benefit coverage (see chart below).

| Percentage of eligible hours worked | Dental coverage percentage |

| Less than 40 % | N/A |

| 41 - 50 % | 50 % |

| 51 - 60 % | 60 % |

| 61 - 70 % | 70 % |

| 71 - 80 % | 80 % |

| 81 - 90 % | 90 % |

| 91 - 100 % | 100 % |

| Example |

|---|

Example: Donna has a permanent part-time position, working 28 hours per week. A full-time person in the same position at her employer works 37.5 hours per week. During a full year, Donna works 1,456 hours and a full-time employee at her organization would work 1,950 hours. Dividing Donna’s hours by the employer’s definition of full-time hours yields a percentage of 75 per cent. Therefore, Donna’s coverage would be 80 per cent for dental benefits. |

The Core Dental Maximum Reimbursement Schedule lists all eligible procedure codes, and the maximum fee amount payable for each eligible procedure code. The Maximum Reimbursement Schedule is available from the 3sHealth web site, or by contacting 3sHealth directly.

The Core Dental Plan is a “positive enrolment” plan, meaning that all eligible dependents are also enrolled into the plan at the same time as the plan member.

The Core Dental Plan covers your employee’s spouse and their eligible dependent children.

A spouse is a person your employee is legally married to or a person that they have been living with in a spousal relationship for the past 12 months, forming a common-law relationship.

The plan defines a child as a person who is under 21, unmarried, dependent on your employee for financial support, and who is either their natural child, their legally adopted child, a stepchild, a child of their common-law spouse who lives with them, or a child for whom they have custody pursuant to a court order.

The plan covers children attending post-secondary education if they are under the age of 25 and are attending an accredited college or university full time.

Children 21 years of age or older that are dependent upon your employee for support by reason of a mental or physical disability can remain under the employee’s plan for as long as they retain their eligibility. In order for a dependent child with a disability to be eligible past age 21, your employee will need to complete an Application for Over-age Dependent Coverage form. Canada Life will review the application for eligibility. If the application is eligible, the plan will cover their dependent child. Please tell your employee to contact 3sHealth if they require the form. Please note that the over-age dependent coverage form may not be a one-time process and Canada Life may review the situation on an ongoing basis depending on the nature of the dependent child’s medical condition.

Inform your employees that they must enroll their spouse and dependent children to ensure benefit plan coverage by completing the Employee Benefits Dependent Change Form.

There are three ways for employees to submit their health and dental claims.

Provider Direct Billing: Canada Life accepts direct billing from service providers such as your employee’s dentist, massage therapist, physiotherapist, and many more. Please tell your employee to ask their service provider if they have Canada Life Provider eClaims.

Online: Your employee can submit claims on Canada Life's My Canada Life at Work website or mobile app once they have signed up. When signing up, they will need to enter the plan number (335663) and their Benefit ID (BID) to register. To receive claim payments right into their bank account, your employee will need to activate direct deposit and elect for electronic documents. My Canada Life at Work will direct them to the set-up process the first time they click on the submit a claim button. Once they set up their account, your employee can submit documents online. Using My Canada Life at Work means a faster claims submission process for your employee.

Paper: Your employee can also submit claims with a paper claim form. They can find these forms on the 3sHealth website or My Canada Life at Work. Advise your employee to complete the claim form, attach their original receipts, and mail the package to Canada Life at:

Regina Benefit Payments

PO Box 4408

Regina, SK, S4P 3W7

Submitting a claim to more than one benefit plan to recover as much of their expenses as possible is known as “coordination of benefits.” Typically, this coordination happens when your employee’s group benefits plan pays part of a claim and then your employee submits the remaining amount to their spouse’s plan. However, having more than one insurance plan does not guarantee that a claim will be paid in full between both plans.

Here are some general coordination of benefits guidelines to give your employee:

- Claims for your employee: Submit THE claim to their plan before sending it in to their spouse’s plan.

- Claims for their spouse: Submit to their spouse’s plan first before sending it to their plan.

- Claims for your employee’s children: Submit to the plan of the parent with the earlier birthday in the year, and then to the plan of the parent with the later birthday.

- Claims for students: Submit through the student’s school plan first, then the parent with the earlier birthday in the year's plan, then the parent with the later birthday’s plan.

- If your employee is unsure how to make claims when parents are separated, tell them to contact Canada Life.

- If your employee has multiple plans, they should start with their full-time employer’s plan, then any part-time employer’s plan, and then any other coverage they carry, such as private insurance or a retiree plan.

- Individual benefit plans, such as the GMS 3sHealth Retiree Benefits Plan, are secondary to all employer-sponsored group benefit plans.

Looking for more information on coordination of benefits? Get the answers you need for your employee’s family situation by referring them to the Canadian Life and Health Insurance Association’s Guide to the Coordination of Benefits. This document sets out common guidelines for coordination of benefits.

When your employee first gains coverage under Core Dental Plan, Canada Life will send them their pay direct drug card in the mail within three to four weeks. If they have a spouse, Canada Life will also send them a card. One of the spouse’s cards can be used for dependent children.

If your employee’s card has been lost or stolen, please report it as soon as possible so that Canada Life can issue a new card. Employees can make their report by:

- Contacting Canada Life through the My Canada Life at Work app advising if the card was lost, stolen, or destroyed.

- Contacting Canada Life directly at 1-866-408-0213 to request a drug card from a customer relations specialist.

- Contacting 3sHealth. We will submit the request for a new drug card to Canada Life on your employee’s behalf.

The My Canada Life at Work mobile app also includes a digital drug card that your employee can use if you have downloaded and activated the app.

3sHealth encourages your employees or their provider to submit an estimate when the cost of the proposed product or service may exceed $500.

Any expenses incurred in the current calendar year must be submitted by April 30th of the following year.

Example: To receive reimbursement for a dental cleaning on Nov. 12, 2023, your employee must submit the claim by April 30, 2024.

If their coverage ends because they did not work enough hours to be eligible for benefits or their employment ended, they must submit claims incurred prior to their last day of coverage within 120 days.

Surviving dependents are eligible for coverage under the Core Dental Plan on the date they qualify as a surviving dependent. No premium payments will be required for the continuation on insurance.

Survivor coverage will terminate on the earliest of:

- In the case of a surviving spouse, the date they remarry;

- In the case of a surviving dependent, the date they no longer satisfy the definition of dependent;

- The date the policy is no longer in force; or

- The date of the second anniversary of the deceased member’s death.

Extended Health Care and Enhanced Dental Plan

Full time positions

Employees will be eligible for health care and dental benefits after working for 26 weeks. When they first gain coverage under the Extended Health Care and Enhanced Dental Plan, Canada Life will send them their pay direct drug card in the mail within three to four weeks. If they have a spouse, Canada Life will also send them a card.

The plans provide coverage for prescription drugs, paramedical services, vision, other medical services and supplies, and dental treatments. Here are the details:

- In-scope employee: Extended Health Care and Enhanced Dental Plan

- Out-of-scope employee: Extended Health Care and Enhanced Dental Plan

Part-time, casual, or temporary positions

After working for 26 weeks, we will measure your employee for eligibility in the Extended Health Care and Enhanced Dental Plan. To qualify, they must work a minimum of 390 hours in their first 26 weeks of work. The number of hours they work compared to your organization’s full-time hours will determine the percentage of their health and dental benefit coverage (see chart below).

| Percentage of eligible hours worked | Dental coverage percentage | Health care coverage percentage |

| Less than 40 % | N/A | N/A |

| 41 - 50 % | 50 % | 50 % |

| 51 - 60 % | 60 % | 60 % |

| 61 - 70 % | 70 % | 70 % |

| 71 - 80 % | 80 % | 100 % |

| 81 - 90 % | 90 % | 100 % |

| 91 - 100 % | 100 % | 100 % |

| Example |

|---|

Example: Donna has a permanent part-time position, working 28 hours per week. A full-time person in the same position at her employer works 37.5 hours per week. During a full year, Donna works 1,456 hours and a full-time employee at her organization would work 1,950 hours. Dividing Donna’s hours by the employer’s definition of full-time hours yields a percentage of 75 per cent. Therefore, Donna’s coverage would be 80 per cent for dental and 100 per cent for health benefits. |

We will send your employee a letter within a few weeks that confirms their eligibility and the level of coverage for which they qualify. Canada Life will send them their pay direct drug card in the mail within three to four weeks. If they have a spouse, Canada Life will also send them a card.

The plans provide coverage for prescription drugs, paramedical services, vision, other medical services and supplies, and dental treatments. Here are the details:

The Extended Health Care and Enhanced Dental Plan covers your employee’s spouse and their eligible dependent children.

A spouse is a person your employee is legally married to or a person that they have been living with in a spousal relationship for the past 12 months, forming a common-law relationship.

The plan defines a child as a person who is under 21, unmarried, dependent on your employee for financial support, and who is either their natural child, their legally adopted child, a stepchild, a child of their common-law spouse who lives with them, or a child for whom they have custody pursuant to a court order.

The plan covers children attending post-secondary education if they are under the age of 25 and are attending an accredited college or university full time.

Children 21 years of age or older that are dependent upon your employee for support by reason of a mental or physical disability can remain under their plan for as long as they retain their eligibility. In order for a dependent child with a disability to be eligible past age 21, your employee will need to complete an Application for Over-age Dependent Coverage form. Canada Life will review the application for eligibility. If the application is eligible, the plan will cover their dependent child. Please tell your employee to contact 3sHealth if they require the form. Please note that the over-age dependent coverage form may not be a one-time process and Canada Life may review the situation on an ongoing basis depending on the nature of the dependent child’s medical condition.

Inform your employees that they must enroll their spouse and dependent children to ensure benefit plan coverage by completing the “Employee Benefits Dependent Change Form.”

There are three ways for employees to submit their health and dental claims.

Provider Direct Billing: Canada Life accepts direct billing from service providers, such as your employee’s dentist, massage therapist, physiotherapist, and many more. Please tell your employee to ask their service provider if they have Canada Life Provider eClaims.

Online: Your employee can submit claims on Canada Life's My Canada Life at Work website or mobile phone app once they have signed up. When signing up, they will need to enter the plan number (335663) and their Benefit ID to register. To receive claim payments right into their bank account, your employee will need to activate direct deposit and elect for electronic documents. My Canada Life at Work will direct them to the set-up process the first time they click on the submit a claim button. Once they set up their account, your employee can submit documents online. Using My Canada Life at Work means a faster claims submission process for your employee.

Paper: Your employee can also submit claims with a paper claim form. They can find these forms on the 3sHealth website or on My Canada Life at Work. Advise them to complete the claim form, attach their original receipts, and mail the package to Canada Life at:

Regina Benefit Payments

PO Box 4408

Regina, SK, S4P 3W7

Your employee can register for access to their health and dental benefit details by signing up at the My Canada Life at Work site. Registering gives them access to a wide variety of features such as their claims history, registration for direct deposit, a drug search tool to confirm if their plan covers their medication, claims submissions, and more.

If your employee is having difficulty registering or navigating the My Canada Life at Work portal, please tell them to contact Canada Life Website Support at 1-888-222-0775.

Submitting a claim to more than one benefit plan to recover as much of their expenses as possible is known as “coordination of benefits.” Typically, this coordination happens when your employee’s group benefits plan pays part of a claim and then your employee submits the remaining amount to their spouse’s plan. However, having more than one insurance plan does not guarantee that a claim will be paid in full between both plans.

Here are some general coordination of benefits guidelines to give your employee:

- Claims for your employee: Submit a claim to their plan before sending it in to their spouse’s plan.

- Claims for their spouse: Submit claims for their spouse to their spouse’s plan first before sending it to their plan.

- Claims for your employee’s children: If the claim is for a child’s expenses, submit it to the plan of the parent with the earlier birthday in the year and then to the plan of the parent with the later birthday next.

- Claims for students: When submitting claims for a student, submit through the student’s school plan first, then the parent with the earlier birthday in the year's plan, then the parent with the later birthday’s plan.

- If your employee is unsure how to make claims when parents are separated, tell them to contact Canada Life.

- If your employee has multiple plans, they should start with their full-time employer’s plan, then any part-time employer’s plan, and then any other coverage they carry such as private insurance or a retiree plan.

- Individual benefit plans, such as the GMS 3sHealth Retiree Benefits Plan, are secondary to all employer-sponsored group benefit plans.

Looking for more information on coordination of benefits? Get the answers you need for your employee’s family situation by referring them to the Canadian Life and Health Insurance Association’s Guide to the Coordination of Benefits. This document sets out common guidelines for coordination of benefits.

When your employee first gains coverage under the health and dental plan, Canada Life will send them their pay direct drug card in the mail within three to four weeks. If they have a spouse, Canada Life will also send them a card. One of the parent’s cards can be used for dependent children.

If your employee’s card has been lost or stolen, please report it as soon as possible so that Canada Life can issue a new card. Employees can make their report by:

- Contacting Canada Life through the My Canada Life at Work app advising if the card was lost, stolen, or destroyed.

- Contacting Canada Life directly at 1-866-408-0213 to request a drug card from a customer relations specialist.

- Contacting 3sHealth https://www.3shealth.ca/contact-employee-benefit-plans. We will submit the request for a new drug card to Canada Life on your behalf.

The My Canada Life at Work mobile app also includes a digital drug card that your employee can use if you have downloaded and activated the app.

The Extended Health Care and Enhanced Dental Plan provides your employee with two options for using their benefits plan to pay for prescription drug claims.

One option is to pay with their pay direct drug card. The second is paying out-of-pocket and submitting a claim.

Your employee’s prescription needs, and their payment preferences determine which option is right for them.

Your employee has the flexibility to change their payment preference each time they visit the pharmacy.

The pay direct drug card

The plan offers a convenient pay direct drug card that provides instant payment at the pharmacy, less a $10 deductible for each prescription. Using the pay direct drug card helps your employee avoid out-of-pocket costs, and there are no claim forms to fill out and submit. The claim process is complete before your employee leaves the pharmacy.

Paying out-of-pocket and submitting a claim

The plan also offers a reimbursement option. Your employee may pay the full amount of their prescription at the pharmacy, submit their claims for reimbursement, and pay a $9 per family, per purchase date deductible. They can submit claims via My Canada Life at Work.

Did you know? A deductible is the amount your employee pays for covered benefits, such as prescription drugs, before their benefit plan starts to pay.

| Example |

|---|

Example: A plan member purchases five different prescriptions on the same day. Using the pay direct drug card, they would pay a $50 deductible ($10 per medication) and pay for any medication costs that the plan does not cover. If that same plan member submits an online or paper claim, they would pay the full cost of the five prescriptions at the time of purchase. They would then submit a claim with receipts to Canada Life. Canada Life would reimburse the plan member the full amount that the plan covers, less the $9 deductible per family, per purchase date. |

3sHealth encourages your employees or their provider to submit an estimate when the cost of the proposed product or service may exceed $500.

Any expenses incurred in the current calendar year must be submitted by April 30th of the following year.

Example: To receive reimbursement for a massage on Nov. 12, 2023, your employee must submit the claim by April 30, 2024.

If their coverage ends because they did not work enough hours to be eligible for benefits or their employment ended, they must submit claims incurred prior to their last day of coverage within 120 days.

All employees need to apply to the Saskatchewan Special Support Program (SSP) to remain eligible for their employer-sponsored drug plan.

The SSP is an income-tested program that helps Saskatchewan residents with high drug costs in relation to their income. The Government of Saskatchewan will send eligible applicants a letter each year that provides deductible and copayment information for coverage under the provincial prescription drug plan. When your employee’s application is complete, their prescription drug costs will be split between your employee, the SSP, and the employer drug plan.

Once your employee applies:

- Saskatchewan’s Ministry of Health determines a family’s deductible, and copayment amounts for their prescription drugs based on the family’s annual adjusted income.

- This annual adjusted income is determined by deducting $3,500 per dependent under age 18 from the combined annual family income.

- The SSP copayment amount is determined by how much the family’s drug costs exceed 3.4 per cent of their adjusted combined income.

- When your employee reaches their family deductible, the SSP will pay a portion before their employer drug plan pays the balance.

Completing this form ensures that your employee will have no disruptions in their drug coverage.

Once they receive their SSP approval letter, advise them to upload a copy of the letter to My Canada Life at Work, email a copy to sdppharmacare@canadalife.com or mail a copy with their plan number (335663) and Benefit ID number to Canada Life at:

P.O. Box 4408

Regina, Saskatchewan S4P 3W7

Please note that employer-sponsored plans are always supplementary to provincial government plans.

Assisting your employees in finding their Benefit Id Numbers (BID). There are many ways for your employee to find their BID. Their BID is on the letter in their initial welcome package and on any other correspondence we send to them. They can also find their BID on their Canada Life pay direct drug card once they are eligible for the health and dental benefits.

Assisting your employees in finding their Benefit Id Numbers (BID). There are many ways for your employee to find their BID. Their BID is on the letter in their initial welcome package and on any other correspondence we send to them. They can also find their BID on their Canada Life pay direct drug card once they are eligible for the health and dental benefits.

Out-of-Scope Flexible Spending Account Plan

The 2026 allocation amount is $979. This amount is pro-rated based on level of extended health care coverage the employee has, as well the number of months remaining in the calendar when they become eligible.

The Out-of-Scope Flexible Spending Account Plan is part of the benefits package for certain out-of-scope plan members.

The purpose of this plan is to support personal health and wellness. Plan members can submit claims for health and wellness-related expenses.

If your organization subscribes to the Out-of-Scope Flexible Spending Account Plan, your employee meets the eligibility criteria set by your organization, and they are eligible for health and dental benefits, they will also have access to the Out-of-Scope Flexible Spending Account Plan.

Eligible plan members can elect to be in either the Lifestyles Spending Account, the Health Spending Account, or both. Each year, eligible employees have money that they can allocate to either of these two accounts.

Plan members can elect 100 per cent of their funds to either plan or can choose a 50 per cent mix of the Lifestyle Spending Account and the Health Spending Account.

When plan members first become eligible for the plan, they have 30 days to choose to which account they would like to allocate their dollars. If the plan member does not make a choice within 30 days, they default into the Health Spending Account for that year.

Here is an overview of both accounts.

Lifestyle Spending Account:

The plan member can only use this account for themselves (except for claiming contributions to spousal RRSPs).

Plan members who allocate their plan dollars to the Lifestyles Spending Account can claim TFSA and RRSP contributions, physical activity-related purchases such as gym memberships, workout equipment, running shoes, and more.

Lifestyle Spending Account claims are taxable at the same rate as a plan member’s income. Employers pay reimbursement for eligible claims as part of their regular payroll.

Health Spending Account:

Plan members can use the Health Spending Account for claims for themselves, for their spouse, and for their eligible dependents. Allocating funds to this account allows plan members to top up health and dental expenses, such as prescription eyeglasses, laser eye surgery, orthodontics, and more.

This plan is a non-taxable benefit and Canada Life directly reimburses plan members.

Yes. Each November, 3sHealth sends all eligible plan members a letter advising them to use up any unused credits and letting them know what next year’s credit amount will be. We also send out a form that allows plan members to switch their allocation for the next year.

Please note that once your employee makes a choice for the following calendar year, that choice is locked in for that year. Plan members must submit their allocation choice by December 31. If a plan member doesn't send in documentation, then their credit allocation will default back to last year's.

Submitting claims is easy and depends on which account your employee is in.

Lifestyle Spending Account:

Plan members can submit claims directly to 3sHealth by sending in the OOS Lifestyles Spending Account Claim Form.

Health Spending Account:

Plan members can submit claims on Canada Life's My Canada Life at Work app.

Inform your employee they must make their purchases for that year’s Out-of-Scope Flexible Spending Account Plan allocation before December 31 to ensure that they do not lose that year’s funds.

The deadlines for submitting claims are:

- Within 60 days after the calendar year end (December 31) for expenses plan members incurred during the previous year.

- Within 60 days of the end of a plan member’s employment for expenses incurred prior to the end of employment.

You can refer them to the Out-of-Scope Flexible Spending Account Plan booklet.

Eligibility

ELIGIBILITY CHART | |||

|---|---|---|---|

| Benefit | Permanent employees | Temporary employees | Casual employees |

Group Life insurance | Automatically enrolled on | Enrolled if they meet 390 hours in first 26 weeks.1 | Enrolled if they meet 390 hours |

Disability Income Plans | |||

| Automatically enrolled on | Not eligible | |

| Automatically enrolled on | Automatically enrolled on | Automatically enrolled on date of hire. |

Health and dental benefits | Automatically enrolled 26 weeks | Enrolled if they meet 390 hours in first 26 weeks.1 | Enrolled if they meet 390 hours in first 26 weeks.1 |

Out-of-Scope Flex Plan | Automatically enrolled 26 weeks | Enrolled if they meet 390 hours in first 26 weeks.1 | Enrolled if they meet 390 hours in first 26 weeks.1 |

1Employees must continue to meet 780 hours each full calendar year.

At 26 weeks of employment, an employee’s hours are measured to see if they qualify for benefits. This can apply to part-time, casual, and temporary employees. They must work a minimum of 390 hours in their first 26 weeks of work to qualify.

The 26-week measure does not apply to full-time employees, as they are automatically eligible for Group Life insurance and disability coverage on their date of hire and at 26 weeks for health and dental benefits.

For the Core Dental Plan, Extended Health Care, and Enhanced Dental Plan, the number of hours your employee works is compared to the number of hours normally worked by a full-time employee. This will determine the percentage of their health and dental benefit coverage.

| Percentage of eligible hours worked | Dental coverage percentage | Health care coverage percentage |

| Less than 40 % | N/A | N/A |

| 41 - 50 % | 50 % | 50 % |

| 51 - 60 % | 60 % | 60 % |

| 61 - 70 % | 70 % | 70 % |

| 71 - 80 % | 80% | 100 % |

| 81 - 90 % | 90 % | 100 % |

| 91 - 100 % | 100 % | 100 % |

To maintain benefit coverage in the future, casual and temporary regular employees must work at least 780 hours in each complete calendar year (Jan. 1 to Dec. 31). If the employee works fewer than 780 hours in any complete calendar year, the plan member loses benefits coverage on December 31 of that year.

For more information on benefit eligibility see the New Employee tab under Life Events.

For non-payroll organizations (employers who do not use AIMS) it is necessary to always submit your Monthly Information Return to keep track of employee hours to see if they qualify for benefits and for what benefits they qualify.

If you are a payroll organization (an employer that subscribes to AIMS), 3sHealth has access to your employee’s eligible hours of work. This is because eligible hours are in the AIMS system as part of payroll and scheduling. If you are a non-payroll organization (an employer that does not use AIMS), you can expect 3sHealth to contact you and ask for the employee’s eligible hours when the employee reaches their 26-week date of employment. This occurs on a weekly schedule.

The 26-week eligibility measure happens bi-weekly for payroll and non-payroll employer employees.

Benefit eligible hours are the hours used to determine an other-than-permanent full-time or part-time employee’s eligibility to receive coverage for benefits. Benefit eligible hours are equivalent to straight time payroll. “Straight time payroll" refers to an employee's regular pay for their standard work hours during a pay period, calculated at their regular hourly rate, and does not include any additional earnings like overtime, bonuses, or paid time off.

Chart Outlining What Hours Are Considered Straight Time Payroll

| Earning types | Status | |

| Status Included in straight time payroll | Status Not included in straight time payroll | |

| Regular | X | |

| Flex time | X | |

| Arranged hours | X | |

| Replacement | X | |

| Escort | X | |

| Orientation/Training | X | |

| Staff education/In-service | X | |

| Grievance/Arbitration | X | |

| Earned time off (straight time portion only) | X | |

| Overtime (straight time portion only) | X | |

| Sick (except lump sum on termination) | X | |

| Vacation (except lump sum on termination) | X | |

| Statutory holiday off | X | |

| Statutory holiday worked (straight time portion only) | X | |

| Paid leave of absence (bereavement, compassion, education, jury, union, family, medical care, serious illness, other), deemed hours to a maximum of 12 months. | X | |

| Unpaid leave of absence (maternity, parental or adoptive leave, education, illness, union, pressing necessity, maternity/parental/adoption, other), deemed hours to a maximum of 12 months. | X | |

| WCB (with net pay top-up benefits) | X | |

| Disability, deemed hours to a maximum of two years and 119 days. | X | |

| Return to work program (employer paid or unpaid) | X | |

| Call back (work portion only) | X | |

| Standby | X | |

| Premium (shift differential, weekend worked) | X | |

| Layoff (deemed hours not included for layoff) | X | |

| Suspension/Disciplinary | X | |

| Strike/Lockout, deemed hours may be included pursuant to the settlement terms of the strike. | X | |

Group Life Hours

Group Life hours are the same hours used to determine benefit eligible hours, but do not include callback or overtime hours. The Group Life hours are used to determine the employees’ Basic Group Life insurance coverage and are collected at the employee's 26-week and annual measures.

Eligible hours are calculated at the 26-week measure and annual measure. They are all hours that are collected after the employee works 26 weeks or one complete calendar year (for the annual measure). They also include deemed hours when calculating eligibility for those employees who were on a leave of absence.

An employee only gets one 26-week measure. If they do not have enough eligible benefit hours to qualify at their 26-week measure, then they must wait a full calendar year (Jan.1 to Dec. 31) to be measured at the annual measure, which will determine if they are eligible for coverage. 3sHealth will send out a request at the end of December to non-payroll organizations (employers who do not use the AIMS system) for employee’s annual hours. For payroll organizations (employers who use the AIMS system), 3sHealth uses the hours in the AIMS payroll and scheduling system to determine eligibility. This procedure is done every year at the same time and is called the annual measure.

- The answer is yes for out-of-scope employees. Out-of-scope employees may have the waiting period waived for the Core Dental Plan, Out-of-Scope Extended Health Care and Enhanced Dental Plan, and Out-of-Scope Flexible Spending Plan.

- The purpose of granting the exception to waive the waiting period is to support employers in the recruitment of employees to key leadership positions.

- Key leadership positions are limited to: CEO, Vice-president, Executive Physician, Executive Director, or Director, or other comparable roles as defined by the employer.

- Requests to waive the waiting period must be submitted in writing by the employer prior to the offer of employment being extended to the potential employee and approved by either the Benefit Services Manager, Employee Benefits or the Director, Employee Benefits.

Annual Measure

This measurement determines if an employee qualifies for benefit coverage effective January 1 based on the eligible hours they worked from January 1 to December 31 of the previous year. 3sHealth measures part-time, temporary, and casual health-care employees. These employees either gain, lose, or maintain their benefit coverage based on the number of hours they worked.

An employee must work a minimum of 780 hours in the complete calendar year to be eligible for benefits. The hours worked determine their eligibility for the Group Life Insurance Plan and the Disability Income Plan, as well as eligibility in and coverage percentage for the Core Dental and Extended Health Care and Enhanced Dental Plans.

3sHealth uses the hours in the AIMS payroll and scheduling system to determine eligibility for payroll organizations. For non-payroll organizations, 3sHealth will send out a request at the end of December for the employee’s annual hours.

Once the annual measure is complete, employees will receive a notification from 3sHealth Employee Benefits explaining their benefit coverage effective January 1. If they are newly enrolled into the benefit plans, they will also receive a welcome package outlining benefit coverage, as well as letting them know who to contact for questions.

3sHealth will also inform you, the employer, when an employee becomes eligible for benefits and what benefits they will receive.

To maintain benefit coverage in the future, casual and temporary regular employees must work at least 780 hours in each complete calendar year (Jan.1 to Dec. 31). If the employee works fewer than 780 hours in any complete calendar year, the plan member loses benefits coverage on December 31 of that year.

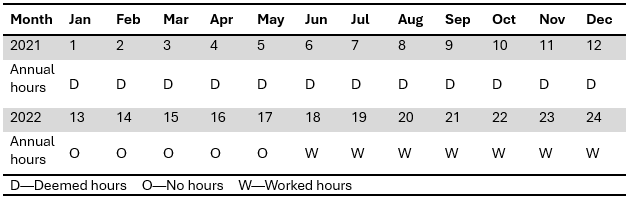

On December 31 each year, all other-than-full-time employees are measured to determine their eligibility for benefits in the next calendar year. Employees must work a minimum of 780 hours in the calendar year to be eligible for benefits. When an employee is on an approved leave of absence, they are not working. However, you, their employer, will submit the hours that they would have worked had they been there. This is called deemed hours. Deemed hours are calculated from the first day of their leave of absence. Deemed hours may be granted for up to 12 months. If they are taking a leave of absence that is less than 12 months, deemed hours will be equal to the length of their leave. If the employee is taking a leave of absence greater than 12 months, deemed hours will only be granted for the first 12 months of the leave. You should discuss deemed hours with your employee before their leave begins. This will help them understand any impact their leave of absence could have on their benefit coverage following their return to work.

Here are two examples of deemed hours:

| Examples |

|---|

|

|

Every year, 3sHealth runs the annual measure in January. Prior to the annual measure activities starting in January, Canada Life places a hold on processing pre-authorizations. This hold occurs in mid-December so that employees are only given pre-approval for benefits they are eligible for in the new year.

Related Links

- Plan Administrators: Staff Changes

In our busy workplaces, employees give notice, change positions and go on leaves of absence. We have answers to all your questions around benefits and staff modifications. - Plan Administrators: Premiums and Contributions

How are premiums and contributions calculated and invoiced, who all is included, we have answers to these questions and more.