Employee Benefit Plans

Premiums and Contributions

To ensure continuation of benefit coverage, employers must remit monthly premiums and contributions to 3sHealth for the benefit plans your organization participates in. How are premiums and contributions calculated and invoiced, who all is included, we have answers to these questions and more.

Employers are responsible for remitting premiums and contributions to 3sHealth.

3sHealth administers group life, extended health care, dental, and disability income plans for health-care system employees.

We are your contact point for everything related to these benefits and disability plans.

Do you have questions about premiums and contributions? This section provides information on everything you need to know.

Calculation of Premiums and Contributions

Some of the plan’s premiums or contributions are based on the hire date of the employee and some are based on the enrolment date of the employee. It is therefore important that you keep all your records up to date and inform 3sHealth when you hire an employee.

The Core Dental Plan contribution is calculated based on the total full-time-equivalent (FTE) count at your organization multiplied by the current core dental rate. To calculate, add up the paid hours for all employees in a bargaining unit (affiliation) for a month and divide by the hours worked by a full-time equivalent at your organization for that month. This will give you your FTE number, which is then multiplied by the core dental rate.

All employees employed within your organization are included in this calculation, regardless of if they are enrolled in the Core Dental Plan or not.

For employers that do not use the AIMS payroll system, the regular hours for the month come from the Monthly Information Return (MIR). This is used to calculate your organizations FTE for that month.

Core Dental Plan rate = $92.50

*This is the rate as of October 1, 2025, and is subject to change.

(Total employee hours/FTE) Core Dental Rate= Core Dental monthly contribution

| Example |

|---|

Ex. An organization’s OOS full-time employees work 162.5 hours in a month (each affiliation may work different hours in a month; therefore, the FTE would be different). Two OOS employees worked 150 hours → 2 x 150 = 300 One OOS employee worked 162.5 hours → 1 x 162.5 = 162.5 Two employees worked 75 hours → 2 x 75 = 150 Four employees worked 55 hours → 4 x 55 = 220 (300+162.5+150+220)/162.5 = 5.12 FTE’s x Core Dental Rate $92.50 = $473.60 is the Core Dental monthly contribution. |

The In-Scope Extended Health Care and Enhanced Dental Plan (EHC and ED) contributions are calculated based on an employee’s regular monthly earnings multiplied by the bargaining unit (affiliation) rate.

All employees employed within your organization are included in this calculation, regardless of if they are enrolled in the EHC and ED Plan or not.

| Bargaining Unit | In-Scope EHC and ED contribution rate |

| CUPE | $0.031 |

| SEIU-West | $0.031 |

| SUN | $0.0275 |

| HSAS | $0.021 |

| SGEU | $0.031 |

| RWDSU | $0.026 |

*This is the rate as of April 1, 2025, and is subject to change.

| Example |

|---|

Ex. There are 40 employees in SUN. Their total earnings for the month equal $244,821.60. Multiply that by the rate $0.0275 (SUN contribution rate) and you get a contribution of $6,732.60. Which is approximately $168.32 per person. $244,821.60 x $0.0275 = $6,732.60$6,732.60/40 = $168.32 per person is the employee’s monthly contribution. |

The employee’s regular monthly earnings are found on the Monthly Information Return (MIR). The MIR is a snapshot of all employees we have on our system. 3sHealth sends the (MIR) on the last Monday of each month to all participating employers that do not use the AIMS payroll system. Each employer will review the required information, make any necessary changes, and return the completed MIR form by the fifth of the following month to EBP@3sHealth.ca.

Out-of-Scope Extended Health Care and Enhanced Dental Plan

The Out-of-Scope (OOS) Extended Health Care and Enhanced Dental Plans (EHC and ED) contribution is calculated based on the percentage of coverage for which an employee is eligible.

An OOS employee must be enrolled in EHC and ED plans to be included in the contribution calculation. If an employee is first enrolled within the first and the fifteenth day of the month, they will be included in that first month’s calculation. If enrolled from the sixteenth to the end of the month, they will be included in the next month’s calculation.

When an employee terminates from the plan between the first and the fifteenth day of the month, they will not be included in that month’s calculation, but they will be included if their termination takes place from the sixteenth to the end of the month.

The rate as of April 1, 2025, is $208.00 per FTE for the Out-of-Scope Extended Health Care and Enhanced Dental Plan. The rate has a portion go towards both dental and health care. The breakdown based on coverage level is:

| OOS Enhanced Dental Plan coverage percentage | Contribution rate |

| 50% | $20.80 |

| 60% | $24.96 |

| 70% | $29.12 |

| 80% | $33.28 |

| 90% | $37.44 |

| 100% | $41.60 |

*This is the rate as of April 1, 2025, and is subject to change.

| OOS Extended Health Care Plan coverage percentage | Contribution rate |

| 50% | $83.20 |

| 60% | $99.84 |

| 70% | $116.48 |

| 100% | $166.40 |

*This is the rate as of April 1, 2025, and is subject to change.

Percentage of enhanced dental (rate) + percentage extended health care (rate) = total monthly contribution for this employee

| Example |

|---|

| Ex. An OOS employee has 80 per cent enhanced dental and 100 per cent extended health care coverage One employee x 33.28 (80%) enhanced dental rate = $33.28 One employee x 166.40 (100%) extended health care rate = $166.40 Total monthly contribution for this employee = $199.68 |

The Disability Income Plan contribution is based on an employee’s regular monthly earnings multiplied by the bargaining unit (affiliation) rate.

An employee must be enrolled into one of the Disability Income Plans that 3sHealth administers to be included in the contribution calculation.

| Bargaining Unit | Contribution rate |

| CUPE | $0.0240 |

| CUPE age 65+ | $0.0090 |

| SEIU-West | $0.0249 |

| SEIU-West age 65+ | $0.0075 |

| SUN | $0.0166 |

| General | $0.0141 |

*This is the rate as of July 27, 2025, and is subject to change.

| Example |

|---|

| Ex. A CUPE employee under age 65 has regular monthly earnings of $4,709.60 and is enrolled in the CUPE disability plan, with a rate of $0.0240 (CUPE contribution rate). $4,709.60 x 0.0240 = $113.03 is this employee’s monthly premium. |

The employee’s regular monthly earnings are found on the Monthly Information Return (MIR). The MIR is a snapshot of all employees we have on our system. 3sHealth sends the MIR on the last Monday of each month to all participating employers that do not use the AIMS payroll system. Each employer will review the required information, make any necessary changes, and return the completed MIR form by the fifth of the following month to EBP@3sHealth.ca.

Group Life insurance – Basic Life

The Basic Life premium calculation is based on the employee’s Group Life insurance volume multiplied by the Group Life rate (Basic + AD&D). Please note the Group Life rate is a combined rate including both Basic Group Life and Accidental Death and Dismemberment.

An employee must be enrolled in the Group Life Insurance Plan to be included in the premium calculation. If an employee is first enrolled within the first and the fifteenth day of the month, they will be included in that first month’s calculation. If enrolled from the sixteenth to the end of the month, they will be included in the next month’s calculation. When an employee terminates from the plan between the first and the fifteenth day of the month, they will not be included in that month’s calculation, but they will be included if their termination takes place from the sixteenth to the end of the month.

Employee Group Life Rate = $0.15* per $1000 of coverage

*This is the rate as of April 1, 2025, and is subject to change.

| Example |

|---|

| Ex. An employee has $150,000 in Basic Group Life, Group Life rate is 0.15 / $1,000. ($150,000 x 0.15)/1,000 = $22.50 is this employee’s monthly premium. |

Plan members have the option to purchase additional Employee Optional Life coverage up to $500,000. The premium rate is based on the age and smoker status of the plan member. To calculate their premium, multiple the volume of insurance by the rate and divide by 1000.

(Volume x Rate)/1,000 = employee’s monthly premium

Rates are per $1000 of coverage.

| Employee non-smoker rate | Employee age | Employee smoker rate |

| $0.44 | Under age 40 | $0.088 |

| $0.075 | Age 40 – 44 | $0.150 |

| $0.106 | Age 45 – 49 | $0.213 |

| $0.250 | Age 50 – 54 | $0.450 |

| $0.425 | Age 55 – 59 | $0.750 |

| $0.594 | Age 60 – 64 | $1.050 |

*This is the rate as of April 1, 2025, and is subject to change.

| Example |

|---|

Ex. An employee has $70,000 optional coverage (seven units), is 47 years of age, and is a non-smoker. The rate for this combination is: 0.106/1,000. ($70,000 x 0.106)/$1,000 = $7.42 is this employee’s monthly premium. |

Plan members also have the option to purchase Spousal Optional Life coverage up to $150,000. The premium rate is based on the age and smoker status of the plan member’s spouse. To calculate their premium, multiple the volume of insurance by the rate and divide by 1000.

(Volume x Rate)/1,000 = employee’s monthly premium

Rates are per $1000 of coverage.

| Employee's spouse non-smoker rate | Employee's spouse's age | Employee's spouse smoker rate |

| $0.44 | Under age 40 | $0.088 |

| $0.075 | Age 40 – 44 | $0.150 |

| $0.106 | Age 45 – 49 | $0.213 |

| $0.250 | Age 50 – 54 | $0.450 |

| $0.425 | Age 55 – 59 | $0.750 |

| $0.594 | Age 60 – 64 | $1.050 |

*This is the rate as of April 1, 2025, and is subject to change.

| Example |

|---|

Ex. An employee has $100,000 spousal optional coverage (ten units). The spouse is 57 years of age and is a non-smoker. The rate for this combination is: 0.425/1,000. ($100,000 x 0.425)/$1,000 = $42.50 is this employee’s monthly premium. |

The Group Life Insurance – Voluntary Accidental Death and Dismemberment (AD&D) premium is based on the employee’s elected volume, as well as whether the coverage is single or family. An employee must be enrolled in the Group Life Insurance Plan and has elected Voluntary AD&D to be included in the premium calculation.

(Volume x Rate)/$1,000 = employee’s monthly premium

| Voluntary AD&D coverage | Premium rate per $1,000 |

| Single | $0.020 |

| Family | $0.040 |

*This is the rate as of April 1, 2025, and is subject to change.

| Examples |

|---|

| Example – single coverage: ($50,000 x $0.20) / $10,000 = $1.00 monthly premium. |

| Example – family coverage: ($50,000 x $0.40) / $10,000 = $2.00 monthly premium. |

Invoice

3sHealth Employee Benefits will generate invoices for remittances to the benefit plans. Employers will be invoiced monthly for premiums and contributions. Prior to paying an invoice, please review it to ensure everything is correct.

For organizations that do not use the AIMS payroll system, premiums and contributions will be invoiced based on the information provided in your organization’s Monthly Information Return (MIR). If you do not return your MIR prior to the fifth of each month the invoices being sent to your organization may be incorrect.

An invoice for all benefit plans that you participate in will be sent to you by the 10th of each month. We require your payments by the 10th of the following month to avoid your organization going into arrears.

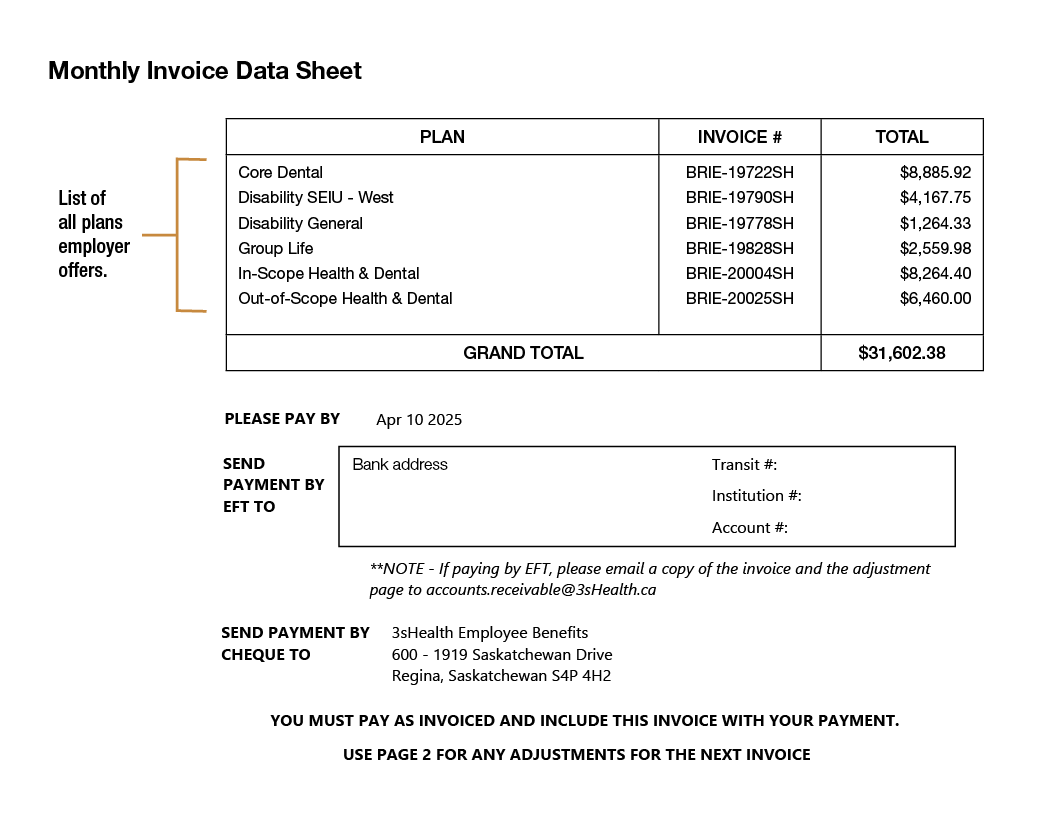

Premiums and contributions calculated for all benefit plans your organization participates in will be included on the invoice you receive from 3sHealth. Your invoice will include a detailed summary of your employees, their benefits, and the contributions calculated.

Each invoice will have a cover sheet with a subtotal for each plan your organization participates in and a grand total at the bottom.

Payments for all benefit plans must be made to 3sHealth Employee Benefits as invoiced. If there is a discrepancy, you must still pay as invoiced but remit the correction on the adjustment page of the invoice to be adjusted on the next month’s invoice. It is important for the adjustments to be handled this way as the system will be updated with the adjustment which will automatically reflect on your next month’s invoice.

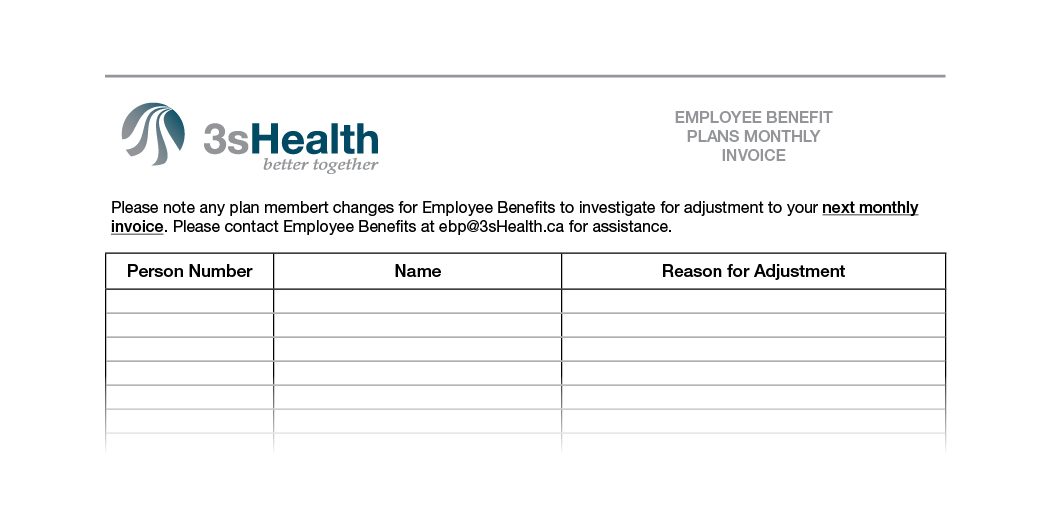

Adjustments

Any errors or inconsistencies on the invoice are treated as adjustments. You, the employer, still pay the full invoice. Indicate what needs to be adjusted on the adjustment page of the invoice and send this along with your payment. Adjustments will then be processed in our system and automatically reflected on your next month’s invoice.

Adjustments must be listed on the adjustment page included with your invoice. Once submitted, it will ensure any credits or amounts owing will be applied to your next month’s invoice.

Example: an employee was terminated in June, but that notice was not sent to 3sHealth; therefore, they were included on the invoice for July.

Pay Premiums and Contributions

3sHealth invoices all employers by the 10th of the month, and the employer has until the 10th of the following month to submit payment.

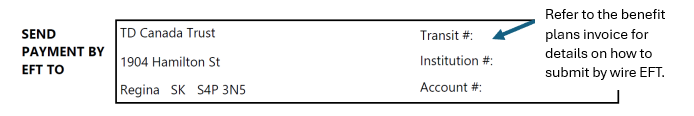

Submit your payments monthly (preferably by electronic funds transfer) and email your supporting documentation to accountspayble@3sHealth.ca.

If you prefer you can pay by cheque. Please send cheque to:

3sHealth Employee Benefits

600 – 1919 Saskatchewan Drive

Regina, Saskatchewan

S4P 4H2

Employers sending your monthly contribution and premium remittances via wire transfer:

Note: if paying by wire transfer, please email a copy of the invoice and the adjustment page to accounts.receivable@3sHealth.ca.

Arrears

If you are late in submitting your contributions or premiums to 3sHealth, you are in arrears. We require your payments by the 10th of the following month to avoid your organization going into arrears. If employer premiums are outstanding, 3sHealth will follow up.

Monthly Information Return (MIR)

3sHealth sends the Monthly Information Return (MIR) on the last Monday of each month to all participating employers that do not use the AIMS payroll system. The MIR is a snapshot of all employees that 3sHealth has in its system for your organization. Employers must ensure this document is up to date. If employees are missing or included when they should have been removed, your invoice for benefit premiums and contributions will not be accurate. Each employer will review the required information, make any necessary changes, and return the completed form by the fifth of the following month to EBP@3sHealth.ca.

Each employer will review the required information, make any necessary changes, and return the completed form by the fifth of the following month to EBP@3sHealth.ca.

There are three main tasks you must do to complete the MIR each month.

Guaranteed Weekly Hours column

This is the number of guaranteed hours an employee is hired with. Update this column only if there is a change to the employee’s guaranteed weekly hours. This information is required for permanent full-time, permanent part-time, and temporary employees to calculate Group Life insurance. It is not required for casual employees, as they do not have guaranteed weekly hours.

Hourly Rate of Pay column

This is the employee’s current rate of pay. Update this column only if there is a change to an employee’s hourly rate of pay. This is required for all employees, regardless of their position, to calculate Group Life insurance.

Last Month’s Straight Time Pay column

This is used to determine the full-time equivalent that is part of the Core Dental Plan premium calculation. It is also used to determine the Disability Income Plan, In-Scope Extended Health Care and Enhanced Dental Plan contributions. This is required for all active employees, regardless of whether they are enrolled in a benefit plan.

Note: if you notice errors in other columns, provide an explanation in the email that you send to return your MIR. Do not try to change the other columns besides the three ones mentioned above.

If the MIR has an employee listed that should be removed or an employee change is required, complete and submit the NPO Employer Changing Information Form.

Complete and submit the NPO New Hire Notification Form.

Related Links

- Plan Administrators: Benefit Plans and Eligibility

How do you know when your employees are eligible for benefits and in which plans? We have answers to all your questions around benefits and eligibility. - Plan Administrators: Staff Changes

In our busy workplaces, employees give notice, change positions and go on leaves of absence. We have answers to all your questions around benefits and staff modifications.